Effective Marketing Tactics for Life Insurance Agents

7 min read

•

Apr 27, 2023

In today's competitive marketplace, effective marketing is essential for the success of any life insurance business.

Life insurance agents can use numerous strategies and tactics to increase their visibility, attract new customers, and build brand awareness. We'll discuss effective marketing tactics, such as email marketing, video marketing, and referral programs.

1. Create a User-Friendly Website

Any business, including life insurance businesses, must have a user-friendly website. A website that is easy to use, loads quickly, and offers valuable content can attract new visitors and keep them interested. Life insurance agencies can utilize clear and concise text, high-quality photos, and videos to build a website that is easy to use. To enhance visibility and generate traffic, they may also ensure their website is optimized for search engines and compatible with mobile devices. Building confidence and trust, which are crucial for effective life insurance marketing strategies, can be facilitated by a user-friendly website.

2. Invest in Search Engine Optimization (SEO)

A hugely successful method for life insurance agencies trying to boost their online presence and improve website traffic is investing in search engine optimization (SEO). They may increase their rankings in search results and make it easier for potential customers to locate them by optimizing their websites for search engines. Researching keywords, producing high-quality content, enhancing the navigation and structure of websites, and constructing backlinks are all examples of SEO approaches.

3. Leverage Social Media

Leveraging social media is a powerful way for life insurance agents to link with their target audience. After creating a social media strategy that aligns with their business goals and target audience, life insurance companies can leverage the power of social media to boost their marketing campaigns and grow their business. Social media platforms offer a range of tools and features that can be used to engage with customers, share valuable content, and promote products and services.

4. Run Pay-Per-Click (PPC) Ads

Pay-Per-Click (PPC) advertising is another successful marketing tactic for insurance providers. PPC advertisements let companies compete for ad space on social media and search engine platforms. PPC allows life insurance agencies to contact potential clients by focusing on particular keywords, demographics, and interests. It is a cost-effective method of generating leads because they only pay when someone clicks on their advertisement.

5. Offer Free Quotes

Offering free quotations is a good way for life insurance providers to draw in new clients and create prospects. Potential clients can learn more about the costs and coverage choices accessible by receiving a free estimate. Potential clients may be more inclined to choose a life insurance provider that provides this service if you can establish their confidence and reputation.

6. Use Video Marketing

Video marketing may be a formidable strategy for life insurance agencies trying to connect with potential clients and explain the advantages of their goods and services. Videos help spread brand recognition and draw in new leads because they are more likely to be shared. Videos can highlight client testimonials, tell anecdotes, or offer informational material. They can be disseminated via email marketing campaigns, websites, and social media.

7. Partner with Other Businesses

By collaborating with other companies, life insurance agents can increase their reach and attract new clients. Life insurance agencies can reach new audiences interested in their goods and services by partnering with related businesses like financial planners or medical facilities. Cross-promotions, co-branded initiatives, and collaborative events are examples of partnerships. These partnerships can improve the life insurance company's reputation, give clients additional value, and establish trust and confidence. It is an excellent tactic for life marketing efforts with a significant impact.

8. Host Events

Life insurance agencies can interact with their target market and offer helpful information about their goods and services by hosting events. Agencies can demonstrate their knowledge and gain the trust of prospective clients by holding events. Events might range from live seminars and conferences to webinars and online workshops.

9. Use Email Marketing

A powerful tool that insurance agents can use to sell their goods and services to prospective clients is email marketing. Companies can directly communicate with their audience and deliver personalized messages, instructional content, and special offers by developing targeted email campaigns. Lead nurturing and client conversion are two other uses for email marketing. Businesses must focus on providing value and developing trust with their audience to generate effective email campaigns.

10. Create Valuable Content

Making helpful content is an effective method to engage new clients and establish credibility and trust with them. Insurance agencies can demonstrate their knowledge and offer value to their audience by creating educational, pertinent, and entertaining content. Some helpful information includes blog articles, infographics, videos, e-books, and whitepapers. Life insurance agencies can position themselves as thought leaders and draw in more leads by disseminating this material through various channels, including social media, email, and websites.

11. Offer Referral Programs

Offering referral programs is a smart strategy for life insurance agents to attract and retain new customers. Referral programs encourage current policyholders to recommend their services to friends and family members in exchange for rewards or discounts. This can help increase brand awareness, trust, and loyalty. Referral programs also help companies tap into new networks of potential customers they may have yet to reach through other marketing channels.

12. Use Influencer Marketing

Influencer marketing is a successful technique for life insurance firms to reach a larger audience and establish a reputation. Companies can advertise their life insurance goods and services with social media influencers with a sizable and active following. It's crucial to pick influencers whose followers fit the market profile the business is trying to reach. Influencers can advertise life insurance through sponsored blog posts, videos, and other forms of content.

13. Offer Bundled Packages

Companies can provide clients more for their money by bundling various insurance products, such as life, house, and auto insurance, into a single package. In addition to encouraging current customers to buy other insurance products from the same provider, this can draw in new consumers looking for complete insurance coverage.

14. Leverage Customer Testimonials

Life insurance firms can gain credibility and confidence from potential clients by utilizing customer testimonials. Practical testimonial formats include case studies, reviews, and video testimonials. Social proof that your life insurance products and services are reliable and beneficial can be obtained from customer testimonials. Businesses can use customer reviews in marketing materials, websites, and social media.

15. Use Data Analytics

Using data analytics, life insurance firms can acquire valuable insights into client behavior and preferences. Life insurance firms can pinpoint areas for improvement in their marketing strategies and customer service by examining statistics like website traffic, click-through rates, conversion rates, and customer feedback. They can utilize the information to target particular client categories more effectively and customize their marketing messaging.

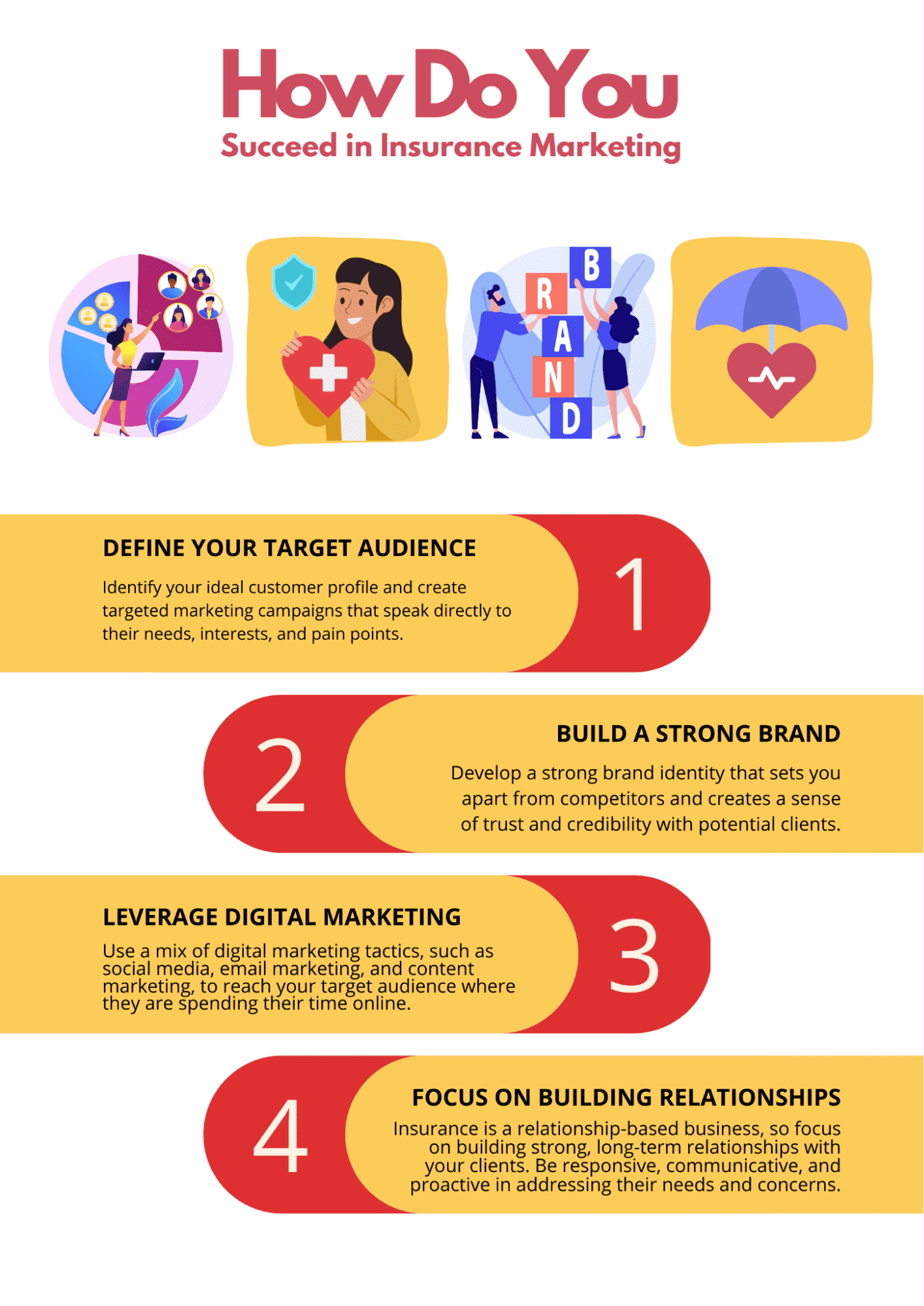

How Do You Succeed in Insurance Marketing?

Understanding your target demographic and their demands is crucial for your success. Create a thorough marketing plan that combines online and offline marketing techniques, including social media marketing, email marketing, events, and referral programs. Setting yourself apart from other businesses is crucial by offering top-notch customer support, customized solutions, and insightful material.

How Do You Market Life Insurance?

Marketing life insurance involves reaching out to potential customers and educating them about the benefits of having life insurance coverage. This can be done through various channels, including social media, email marketing, direct mail, and in-person consultations. It's important to highlight the key features of the policy, such as the death benefit, premiums, and any riders that may be available.

How to Promote Your Life Insurance Online?

It can be challenging to market life insurance, but you can employ several efficient tactics to boost your exposure and connect with more potential clients. Start by building a credible online presence by designing a search engine-friendly website. Use social media to interact with your audience by publishing instructive articles about

Can Life Insurance Agents Advertise?

Life insurance agents are permitted to market their services but are subject to specific rules and requirements. Advertising for life insurance agents must be truthful, not deceptive, and follow all rules and regulations that may be relevant.

You can distinguish yourself from competitors and be successful by being aware of your target demographic and keeping up with current market trends. To stay competitive, remember to deliver top-notch customer service, valuable material, and a constantly innovative approach.